- China consolidates firmness after the Lunar New Year

- Exports to the Middle East affected by the war

- Record average value for finished male in reais

- Uruguay and Argentina to access nearly 20,000 tons under new EU quota from May

- Uruguayan average beef export value in February surpassed 2022 highs

- Industry “extremely excited”: Argentina to be allowed to export cuts under new U.S. beef quota

- Interview with Claudio Corso, CEO of Albasoft - “We integrate the entire plant process into a single system”

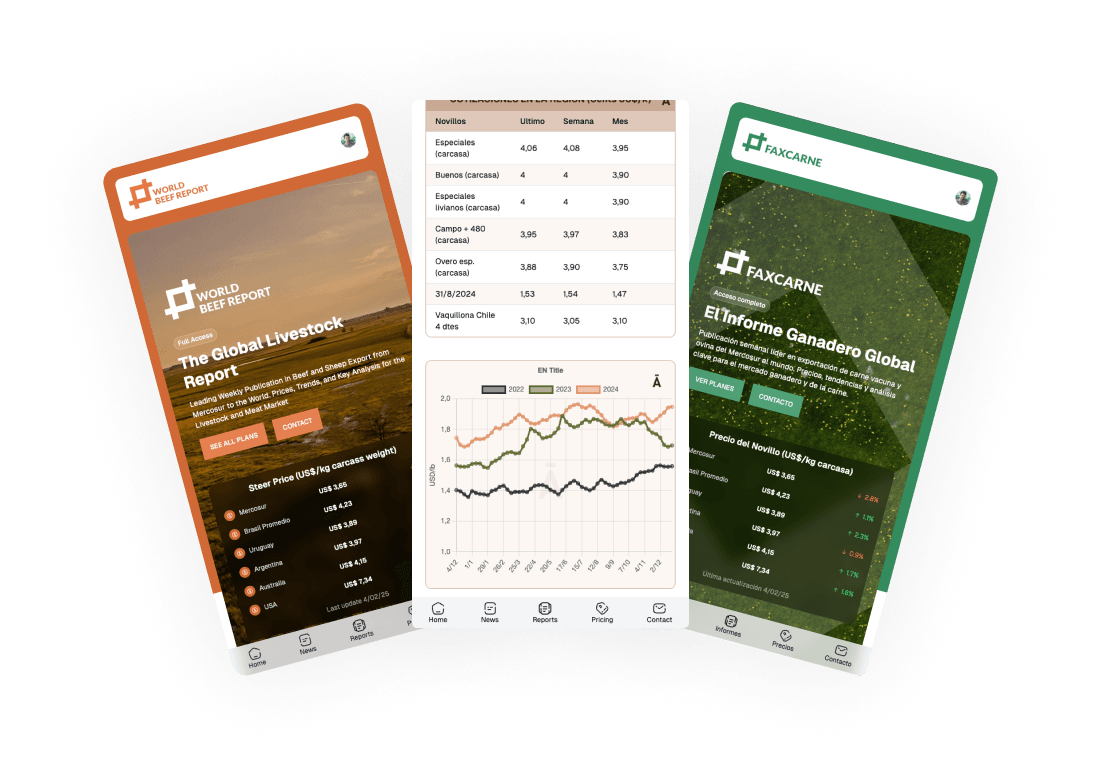

Full Access

With your subscription you will have access to more than 12,000 articles and 29 indicators, with information on the Mercosur beef and sheep export market to the rest of the world.

The perfect combination of creativity and technical skill.

Ideal formula of people to obtain excellent and reliable information.

We believe in the power of information

We provide accurate and reliable information to make strategic decisions in the livestock and meat market.

+3000

CLIENTS

+1500

REPORTS

+50.000

DATA

+2500

UNIQUE USERS

Stay Updated

Subscribe to our weekly newsletter and receive the latest market insights, price trends, and industry analysis directly in your inbox.